1120-EN

1120-2024

$700.00

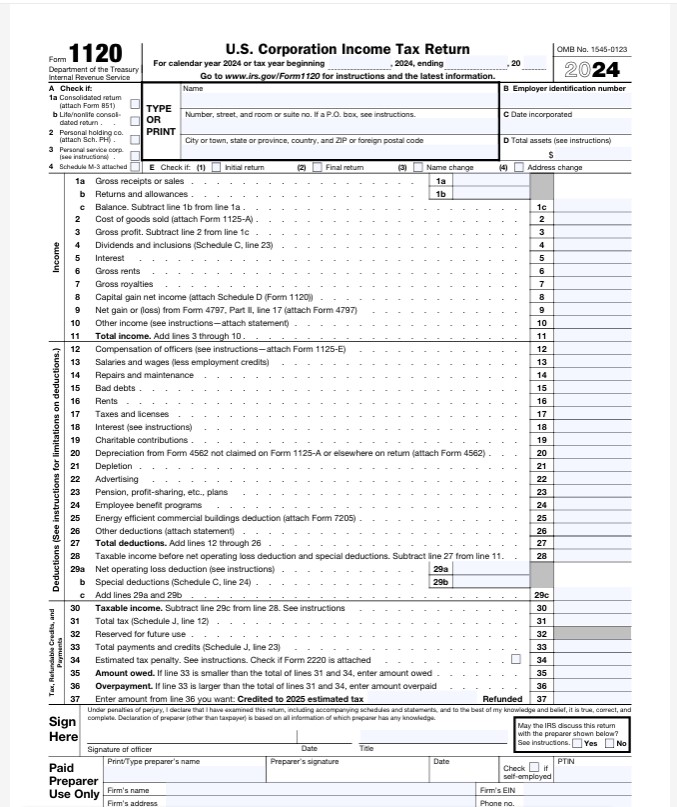

Form 1120 – U.S. Corporation Income Tax Return

The primary income tax return for C corporations in the United States. It reports the corporation’s income, deductions, gains, losses, and tax liability. Corporations must file Form 1120 annually, even if they have no taxable income.

💰 Preparation starts at: $700

https://www.irs.gov/instructions/i1120 Instructions for Form 1120 (2024)

Form 1120 – Summary (Tax Year 2024)

Who files:

Domestic C corporations doing business, incorporated, or deriving income in the U.S.

Foreign corporations engaged in a U.S. trade or business (unless filing Form 1120-F).

Certain LLCs taxed as corporations (by election under Form 8832).

Filing deadline:

April 15, 2025 — for calendar-year corporations.

15th day of the 4th month after the end of the fiscal year for fiscal filers.

(Extension available with Form 7004.)

Main sections:

Income: gross receipts, returns/allowances, dividends, interest, rents, and other income.

Deductions: salaries, rent, taxes, depreciation, charitable contributions, etc.

Tax computation: corporate tax rate (21%), alternative minimum tax (if applicable).

Payments and credits: estimated tax payments, overpayments, and refundable credits.

Key schedules:

Schedule C – Dividends, inclusions, and special deductions.

Schedule J – Tax computation and payment.

Schedule K – Other information (ownership, accounting methods, etc.).

Schedule L – Balance sheet per books.

Schedule M-1 / M-2 – Reconciliation of income and retained earnings.

Filing options:

Electronic filing (e-file) through approved software providers.

Paper filing by mail if e-filing is unavailable.

Common attachments:

Forms 1125-A (COGS), 1125-E (Officer compensation), 4562 (Depreciation), 4797 (Asset sales), 8825 (Rental income), and supporting statements.