1120-S-EN

1120-S-2024

$700.00

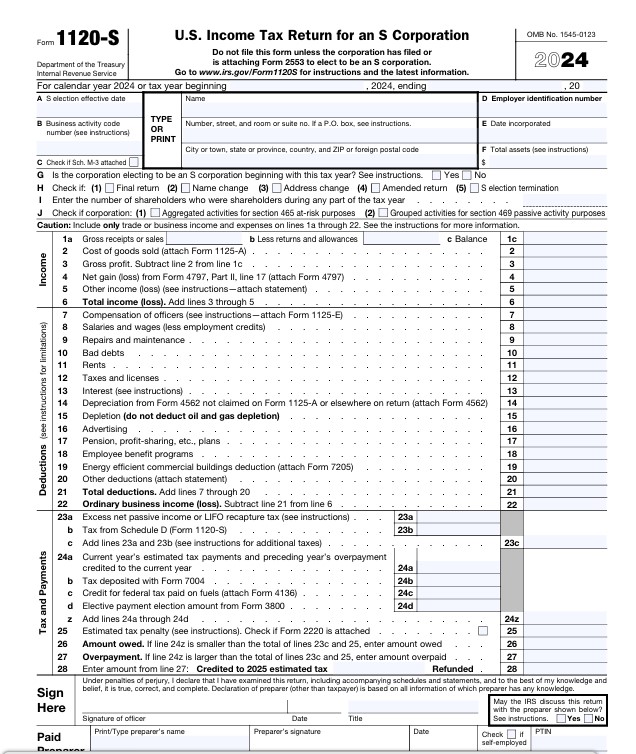

Form 1120-S – U.S. Income Tax Return for an S Corporation

The main U.S. income tax return for S corporations, used to report the company’s income, deductions, credits, and other financial information. While the S corporation itself generally does not pay federal income tax, it must file Form 1120-S to report results, and its income or loss passes through to shareholders via Schedule K-1.

💰 Preparation starts at: $700

https://www.irs.gov/instructions/i1120s Instructions for Form 1120-S (2024)

Form 1120-S – Summary (Tax Year 2024)

Who files:

Domestic corporations that have elected to be treated as S corporations by filing Form 2553.

LLCs that elected S-corp taxation.

Small business corporations with no more than 100 shareholders and meeting other eligibility rules.

Filing deadline:

March 17, 2025 (for calendar-year S corporations).

15th day of the 3rd month after the end of the fiscal year for fiscal filers.

(Extension available with Form 7004.)

Main sections:

Income: sales, cost of goods sold, dividends, interest, rental income.

Deductions: salaries, rent, taxes, depreciation, employee benefits.

Tax and payments: built-in gains tax, excess net passive income tax.

Shareholder information: profits, losses, credits allocated via Schedule K and K-1.

Key schedules:

Schedule K – Summary of income, deductions, and credits for all shareholders.

Schedule K-1 – Each shareholder’s share of income, deductions, and credits.

Schedule L – Balance sheet per books.

Schedule M-1/M-2 – Reconciliation of income and retained earnings.

Filing options:

Electronic filing (IRS e-file) or paper submission by mail.

Must include EIN, business activity code (NAICS), and shareholder information.

Common attachments:

Forms 1125-A (COGS), 1125-E (Officer compensation), 4562 (Depreciation), and state K-1 equivalents.