1040-NR-EN

1040-NR-2024

$350.00

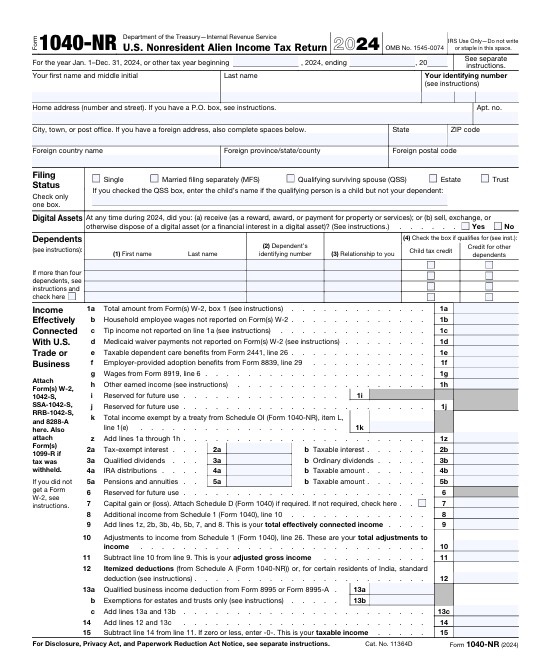

Form 1040-NR – U.S. Nonresident Alien Income Tax Return

The main U.S. income tax return for nonresident aliens — individuals who are not U.S. citizens or residents but have U.S.-source income (such as business, freelance, rental, investment, or royalty income).

Form 1040-NR is used to report income effectively connected with a U.S. trade or business and other fixed or determinable annual or periodic (FDAP) income, such as dividends or royalties. It also allows eligible taxpayers to claim treaty benefits and deductions.

💰 Preparation starts at: $350

https://www.irs.gov/instructions/i1040nr full Instructions for Form 1040-NR (2024)

Form 1040-NR – Summary (Tax Year 2024)

Who files:

Nonresident aliens with U.S.-source income.

Foreign owners or members of U.S. LLCs.

Individuals who earn income in the U.S. without being U.S. residents or citizens.

Filing deadlines:

April 15, 2025 — if wages (Form W-2) are reported.

June 15, 2025 — if no wages are earned in the U.S.

(Extension available by filing Form 4868.)

Main sections:

Income from U.S. sources (wages, business, rental, royalties, capital gains).

Deductions related to effectively connected income.

Tax calculation and treaty-based exemptions.

Withholding and payments (e.g., from Forms W-2 or 1042-S).

Schedules:

Schedule A (Form 1040-NR) – Itemized deductions for nonresident aliens.

Schedule OI – Other Information (country of residence, visa type, days in U.S.).

Schedule NEC – Income not effectively connected with a U.S. trade or business (e.g., dividends, royalties).

Filing options:

Paper filing by mail to the IRS (limited e-file availability).

Must include foreign address and original signature.

Common attachments:

Forms W-2, 1042-S, 1099, ITIN/SSN documentation, and tax treaty statement (if applicable).