1040-EN

1040-2024

$150.00

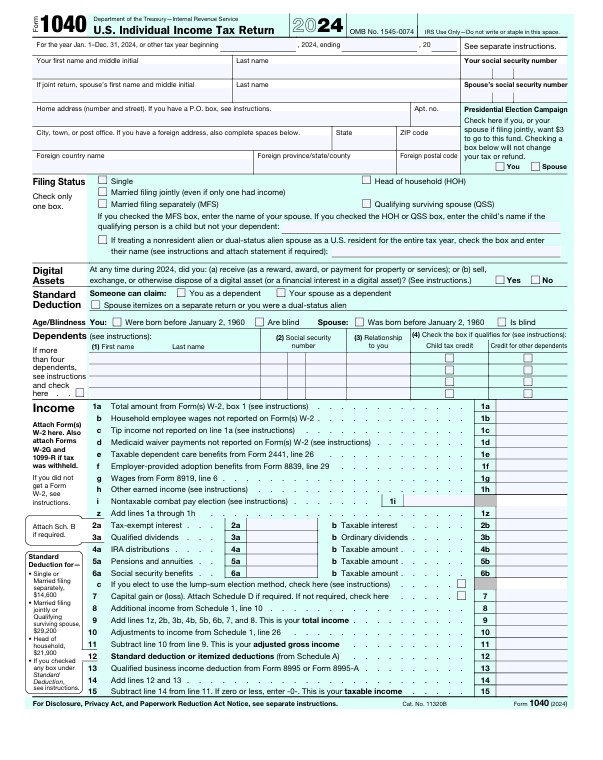

The main individual income tax return for U.S. citizens and residents. Reports income, deductions, and tax credits.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

from $150

https://www.irs.gov/instructions/i1040gi full 1040 - Introductory Material

Form 1040 Instructions — Summary (Tax Year 2024)

Who files: U.S. citizens and residents reporting worldwide income.

Filing deadline: April 15, 2025 (extension available with Form 4868).

Main sections:

Income reporting (wages, business, interest, dividends, capital gains).

Adjustments (educator expenses, IRA contributions, self-employment tax).

Deductions (standard or itemized).

Tax credits (Child Tax Credit, Education, Earned Income Credit).

Payments and refunds (withholding, estimated tax, refund options).

Schedules:

Sch. 1 – Additional income & adjustments

Sch. 2 – Additional taxes

Sch. 3 – Nonrefundable & refundable credits

Sch. C – Business income/expenses

Sch. SE – Self-employment tax

Filing options: e-File via IRS Free File, authorized software, or paper mail.

Common attachments: W-2, 1099 forms, and supporting schedules.