1065-EN

1065-2024

$700.00

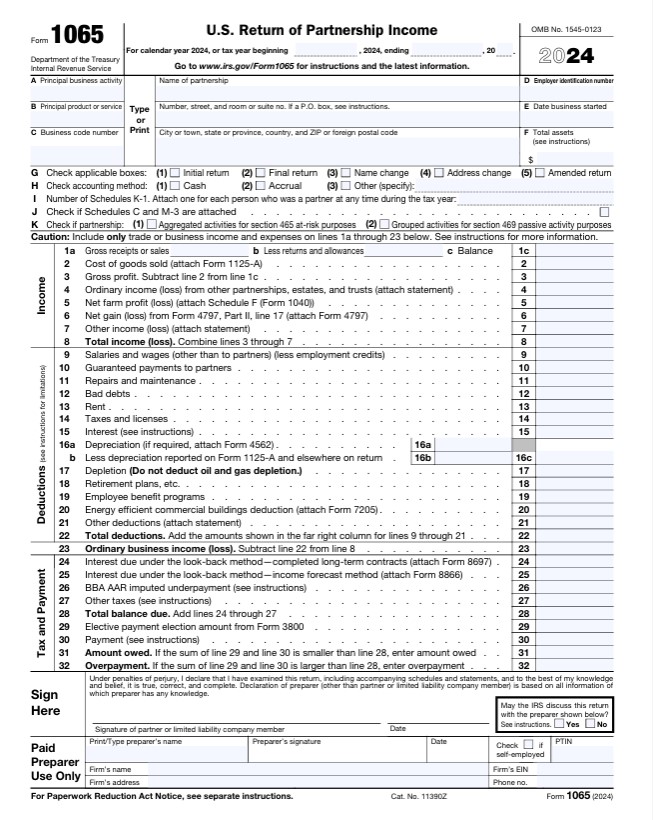

Form 1065 – U.S. Return of Partnership Income

The primary U.S. income tax return for partnerships and multi-member LLCs. It reports the partnership’s income, deductions, gains, and losses, but the partnership itself does not pay federal income tax. Instead, profits and losses “pass through” to partners, who report them individually on Schedule K-1 and their personal tax returns.

💰 Preparation starts at: $700

📄 Official instructions: https://www.irs.gov/instructions/i1065

Form 1065 – Summary (Tax Year 2024)

Who files:

Partnerships (two or more partners).

Multi-member LLCs treated as partnerships for tax purposes.

Foreign partnerships with U.S.-source income or U.S. operations.

Filing deadline:

March 17, 2025 for calendar-year filers.

15th day of the 3rd month after the end of the fiscal year for fiscal partnerships.

(Extension available with Form 7004.)

Main purpose:

To report partnership income, deductions, and other tax items, and allocate each partner’s share through Schedule K and Schedule K-1.

Main sections:

Income: gross receipts, sales, rental income, interest, dividends.

Deductions: salaries, rent, depreciation, taxes, guaranteed payments.

Analysis: balance sheets, capital accounts, and partner distributions.

Schedules K & K-1: pass-through of income, deductions, credits to partners.

Key schedules and attachments:

Schedule B-1 – Information on partners owning 50%+ interest.

Schedule K – Summary of income/deductions for the partnership.

Schedule K-1 – Each partner’s share of income and deductions.

Schedule L – Balance sheet per books.

Schedule M-1 / M-2 – Reconciliation of book income and partners’ capital.

Form 8825 – Rental real estate income (if applicable).

Filing options:

Electronic filing (IRS e-file) or paper submission by mail.

Each partner receives a Schedule K-1 by the due date.

Common attachments:

Form 4562 (Depreciation), Form 4797 (Asset sales), Form 6252 (Installment sales), Form 8949/Schedule D (Capital gains/losses).