4868-EN

4868-2024

$50.00

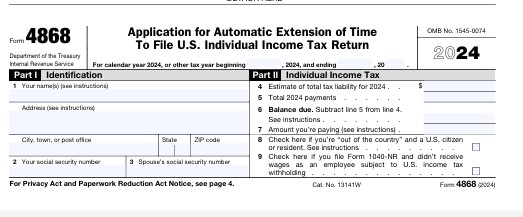

A U.S. citizen or resident files this form to request an automatic extension of time to file a U.S. individual income tax retur

💰 Preparation starts at: $50

https://www.irs.gov/forms-pubs/about-form-4868 Form 4868

Purpose of Form Use Form 4868 to apply for 6 more months (4 if “out of the country” (defined later under Taxpayers who are out of the country) and a U.S. citizen or resident) to file Form 1040, 1040-SR, 1040-NR, or 1040-SS.

Gift and generation-skipping transfer (GST) tax return (Form 709 or 709-NA). An extension of time to file your 2024 calendar year income tax return also extends the time to file Form 709 or 709-NA for 2024. However, it doesn’t extend the time to pay any gift and GST tax you may owe for 2024. To make a payment of gift and GST tax, see Form 8892. If you don’t pay the amount due by the regular due date for Form 709 or 709-NA, you’ll owe interest and may also be charged penalties. If the donor died during 2024, see the instructions for Forms 709 or 709-NA, and 8892.