5472-EN

5472-2024

$350.00

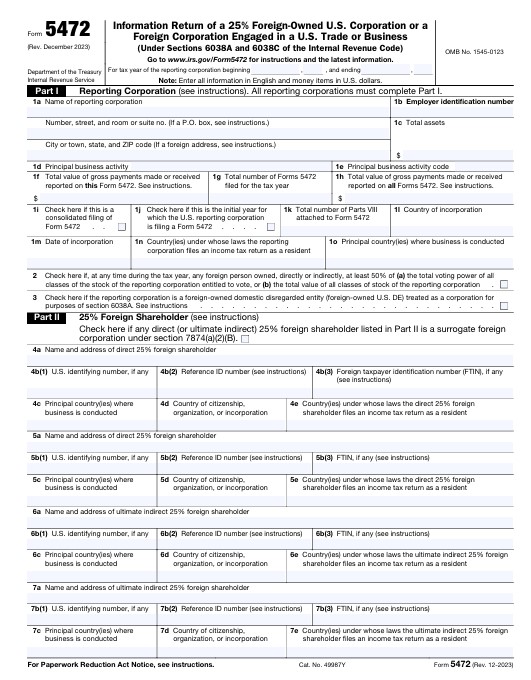

Form 5472 – Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business (Rev. 12/2024)

Used to report transactions between a U.S. corporation with at least 25% foreign ownership (direct or indirect) and its foreign related parties, or by a foreign corporation engaged in a U.S. trade or business. The form allows the IRS to monitor cross-border transactions and prevent tax avoidance through transfer pricing or underreporting.

💰 Preparation starts at: $350

📄 Official instructions: https://www.irs.gov/instructions/i5472

Form 5472 – Summary (Tax Year 2024)

Who files:

A U.S. corporation that is 25% or more foreign-owned (directly or indirectly).

A foreign corporation engaged in a U.S. trade or business.

A disregarded entity (DE) that is 100% foreign-owned and required to file Form 5472 under Treas. Reg. §1.6038A-1.

Filing deadline:

Filed with Form 1120 or Form 1120-F, by April 15, 2025 (for calendar-year taxpayers).

Extension available with Form 7004.

Form 5472 must be attached to a “pro forma” Form 1120 for disregarded entities.

Main purpose:

To disclose reportable transactions between the reporting corporation (or DE) and foreign related parties.

To ensure compliance with transfer pricing and related-party disclosure rules under IRC Sections 6038A and 6038C.

Main sections:

Part I – Reporting corporation information (EIN, ownership, country, etc.)

Part II – 25% foreign shareholder information.

Part III – Related party information (each foreign related party listed separately).

Part IV – Monetary transactions (sales, rents, royalties, interest, services, loans, etc.).

Part V–VIII – Additional reporting for partnerships, cost-sharing, base erosion, and hybrid arrangements.

Filing requirements for DEs:

A foreign-owned single-member LLC must file pro forma Form 1120 + Form 5472 annually, even with no income.

Failure to file results in a $25,000 penalty per year per entity, increasing by $25,000 every 90 days after IRS notice if not corrected.

Common attachments:

Related-party transaction schedules.

Statement describing the nature of the business and transactions.

Supporting documentation for intercompany loans, interest, or service fees.