8858-EN

8858-2024

$400.00

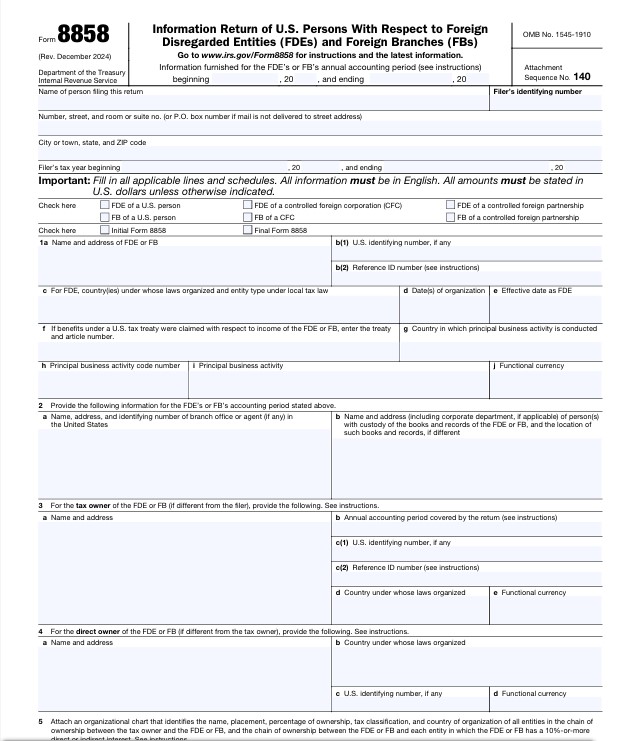

Form 8858 – Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

Used by U.S. taxpayers to report information about foreign disregarded entities (FDEs) and foreign branches (FBs) they own or operate. The form helps the IRS ensure that foreign activities and income of U.S. persons are properly disclosed and taxed.

💰 Preparation starts at: $400

📄 Official instructions: https://www.irs.gov/instructions/i8858

Form 8858 – Summary (Tax Year 2024)

Who files:

U.S. citizens, residents, and domestic entities that own or operate a foreign disregarded entity (FDE).

U.S. persons that own an interest in a controlled foreign corporation (CFC) or foreign partnership that holds an FDE.

U.S. taxpayers operating a foreign branch directly or through an entity.

Filing deadline:

Filed with the taxpayer’s income tax return (e.g., Form 1040, 1065, 1120, 1120-S).

Due on the same date as the main return, including extensions.

Main purpose:

To report balance sheet, income statement, and transactions between the FDE/FB and related entities.

To ensure compliance with IRC Sections 6038, 367, and 954 (Subpart F, GILTI).

To prevent underreporting of foreign income or transfer pricing misstatements.

Main sections:

General information about the foreign entity or branch.

Functional currency and accounting method.

Income statement and balance sheet for the FDE/FB.

Report of transactions with the U.S. owner or related parties.

Exchange rate and translation details.

Filing options:

Must be attached to the filer’s main tax return (electronic or paper).

One Form 8858 per FDE or foreign branch.

Common attachments:

Schedule M (Form 8858) – Transactions between the FDE/FB and related parties.

Schedule C (Form 8858) – Income statement.

Schedule F (Form 8858) – Balance sheet.

Form 5471 / 8865 if the FDE is held through a CFC or foreign partnership.